In response to recent posts on basic doubts about investing, I decided to create this memo to give a simple and succinct explanation of how to invest.

Step Zero: Have a Business or a Job that provides you income. Spend Less that you earn.

First step: create an Emergency Fund/Liquidity Reserve. Function: to meet unexpected expenses and/or opportunities. Amount: minimum 3 months of current expenses. I would do between 6 months and 1 year to be really cool in my day to day.

Second step: create an investment portfolio through exposure to more conservative financial products (shares, bonds, gold and/or property, ETF). Reserve always 2%-5% to more speculative assets like crypto, a new market trend, or something that seem excting to you at some point.

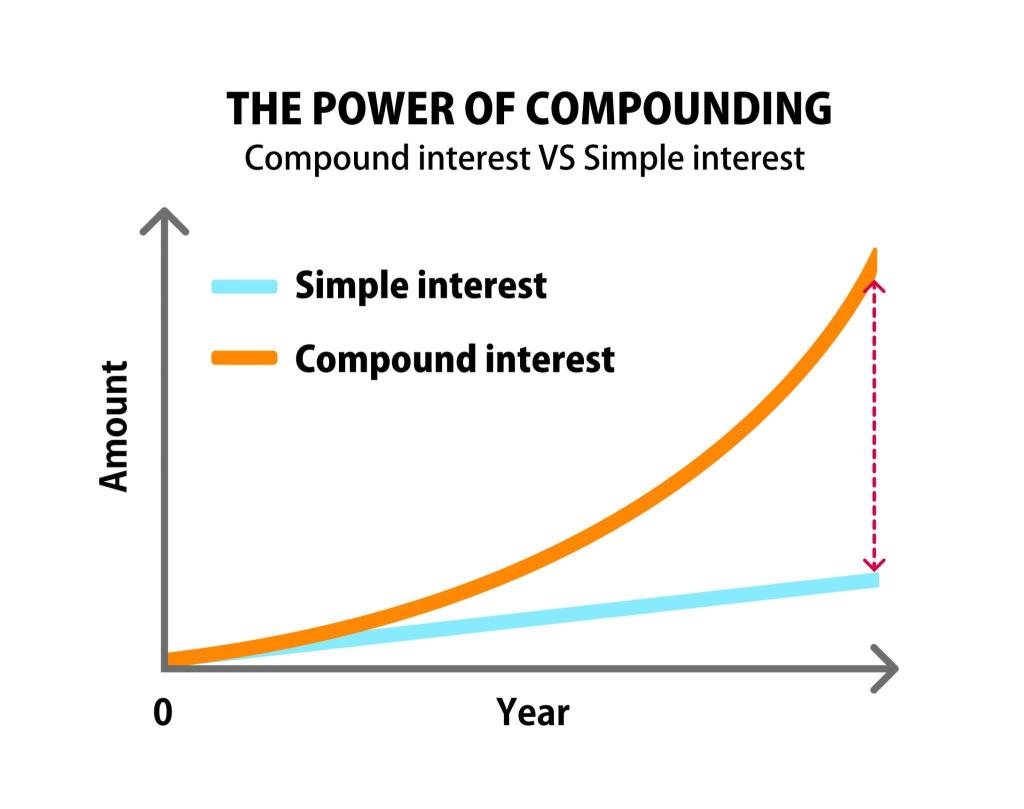

Third Step: Invest in a regular(monthly, annually, weekly) way a % of your earnings during the next 30 years in a cumulative product (an ETF that reinvest the dividends)so you dont have to pay yearly taxes. And then, Let it roll!

When building an investment portfolio, 3 risks must be taken into account:

. Idiosyncratic risk: risk associated with a specific asset and/or asset class.

Resolution: Diversification (the following examples are merely demonstrative)

- Nvidia share (or any other company) – maximum level of idiosyncratic risk

- S&P 500 Information Technology Sector (geographical concentration, sectoral concentration) – lowest idiosyncratic risk

- S&P 500 (geographic concentration, sector diversification) – lowest idiosyncratic risk

- MSCI World (geographical diversification, sectoral diversification, currency diversification) – lower idiosyncratic risk – but Big Part of this “world” ETFs have big exposition to United States stock Market.

- FTSE All-World/ACWI (even greater geographical and currency diversification) – lower idiosyncratic risk

- Mixed portfolio of Shares and IG Bonds (lower correlation index between assets) – lower idiosyncratic risk – and lower return =)

- Mixed portfolio of Shares, IG Bonds, Gold and Real Estate (lower idiosyncratic risk)

As Markowitz noted in his Portfolio Theory, a reduction in idiosyncratic risk can lead to a reduction in the absolute returns of a portfolio but not in the risk-adjusted returns, the latter being the most important for a long-term non-professional investor.

Note: When looking to diversify an equity portfolio, you’re looking for an ETF that replicates a diversified equity fund, not two or more ETFs that replicate the same sector or geography. More ETFs in an investment portfolio is not synonymous with diversification. It’s a very common mistake among novice investors.

. Systematic risk: that which refers to the entire market.

Resolution: time in the market

Empirical evidence suggests a minimum investment period of 20 years for a significant reduction in this risk. Empirical evidence shows that it is after 20 years that the stock market shows real returns of ~5%/year more than 95% of the time.

. Tail Risks: rare and extremely unpredictable events. The famous Black Swan events that nobody can predict.

Resolution: split investments between more than one broker or more, if you can even countries. Split the way you save your investment between digital and physical.

Conclusion: If you do this to you and for your kids(sooner the better) will be ahead of most of the world population and you will be able to protect your money value against the continuous inflation in which the monetary system is based. Theses day Investing is not an option but a necessity.