ETFs (Exchange Traded Funds) are very attractive and recurrent in investors’ portfolios, as they combine the diversification characteristics of mutual funds and the ease of trading shares at low costs. In this way, they are an excellent vehicle for small investors to achieve their goal of long-term returns.

Currently, there are thousands of ETFs marketed worldwide and, according to Fidelity, more than 2,000 ETFs are listed on American exchanges. So it’s entirely natural to feel confused in the process of deciding which ETF, or ETFs, you’re going to invest in.

However, throughout this article, we’ll help you demystify and understand what you need to take into account when making your decision so that you can invest independently.

What are ETFs?

ETFs are a financial product that allows you to replicate the performance of an index, sector, commodity or other underlying asset. As such, it is an investment vehicle that can be structured in various ways, from exposure to a single asset (such as the price of a commodity) or a single market, to diversification across a wide range of securities or markets.

ETFs are an exchange-traded security with a market price associated with it, at which you can buy or sell it. When you buy a share, you’re buying a small portion of the ETF’s underlying assets, which will be proportional to the amount invested (for the sake of simplicity, think of one ETF share as buying a “basket” of assets).

What are the benefits of ETFs?

The first and perhaps most important benefit of ETFs is the simplicity and speed with which you can obtain a diversified portfolio at low cost. Imagine that you believe in the American economy and therefore independently decide to buy shares in each of the 500 companies that make up the S&P 500.

Apart from the time lost, your portfolio would be much lighter, given the costs for each transaction. By buying a unit in an ETF, you would only pay a commission for one transaction and have access to the same set of shares.

In addition to transaction costs, ETFs also offer investors the privilege of paying lower management costs (associated with the usual passive management) compared to mutual funds (which usually have active management and therefore more administrative costs).

Being traded on the stock exchange, ETFs have the same flexibility of transaction and liquidity as a share, i.e. they can be traded at any time as long as the markets are open, and include options, futures, short selling, limit and stop-loss orders, and margin calls.

In tax terms, they are much more efficient than mutual funds. While the latter impose taxes on their clients resulting from the capital gains they realise throughout the year, in ETFs the investor is only taxed when they decide to realise the capital gains.

Finally, transparency will also be an important benefit to consider, as the financial institutions behind an ETF are required to publish information on a regular basis.

What kind of ETFs there are in the market?

Briefly, the following list represents the diversity of possible choices in terms of assets and investment strategies:

Market index ETFs – replicate the performance of an index, such as the S&P 500.

Bond ETFs – replicate the performance of a set of bonds such as government and corporate bonds.

Currency ETFs – replicate the price movement of one currency or several currencies.

Commodity ETFs – replicate the price movement of commodities such as gold and oil.

Sector and industry ETFs – replicate the performance of a particular sector or industry, such as the technology sector.

Sustainable ETFs – are ETFs that support ESG criteria. Recently, this sustainable investment method has seen rapid growth.

Inverse ETFs – through financial derivatives, these ETFs aim to profit from falls in a certain index and therefore replicate the taking of several short positions.

Leveraged ETFs – These allow investors to leverage their position (by taking out a loan to finance the investment) and thus boost their returns (with a consequent increase in risk).

Investment style ETFs – adopt a specific investment strategy, such as focusing their investment on companies with a large market capitalisation.

Actively managed ETFs – their active management aims to outperform the market and thus obtain a better return than a given index.

ETNs (exchange traded notes) – are a debt financial instrument which, like ETFs, follow the performance of a particular index. However, in this case, the fund does not own the securities of the index it replicates, and provides the returns of the index at maturity, paying no coupon.

10 Things to consider when selecting your ETF(s)

As with other financial products, there is no single perfect solution for all investors. Therefore, you should carefully analyse the characteristics of each ETF, taking into account your investor profile and investment strategy, in order to find the most suitable one. Two useful platforms for analysing ETFs (in addition to the websites of the management companies themselves) are Morningstar and JustETF.

Below we will list the aspects you should consider.

What is your investment strategy?

Before doing an exhaustive search through the list of thousands of ETFs, you should narrow it down and first ask yourself why you are interested in investing in an ETF. Do you want exposure to the world economy or just an economy like the US? Or only invest in a certain industry? Or, for example, just focus your investment on gold?

Also, how long are you looking to hold this ETF? 1 year? 10 years? 20 years? Since most ETFs in some way follow an index, the greatest returns will be obtained over the long term. However, for short-term investments, ETNs and inverse ETFs are more recommended.

Understand the underlying asset

Let’s imagine that you believe the American economy will prosper and are therefore looking for an ETF that replicates the S&P 500 index. This will certainly be a big step towards narrowing down your search list, but even so, there are several management companies that offer this financial product.

Just like when you buy a second-hand car, the key is to check what’s under the bonnet. In this case, the key is to understand how the portfolio is managed. To do this, you should look at the proportions of asset classes and the allocation by country, region and sector. For example, although two ETFs replicate the same index, there may be a clear distinction in the percentage of diversification by sector.

So don’t assume that because they have the same underlying asset, all ETFs are the same.

Size of assets under management

The size of the assets under management, both in terms of the management company and the ETF itself, is an important factor to consider when investing. Investors should look for companies with a high level of assets under management that provide security, credibility and a good reputation. Examples include BlackRock, Vanguard and Fidelity.

In the case of the ETF itself, it should have a minimum level of 10 million dollars, not only for credibility, but also to attract a larger number of investors, which translates into greater liquidity and smaller spreads.

Costs

As mentioned above, ETFs are fairly inexpensive. However, you should take into account the costs associated with managing the fund, which are measured by the current expense ratio (TEC) or total expense ratio (TER). Total costs include management fees, trading fees (spreads and brokerage commissions), legal fees, marketing fees, auditing fees and other operating expenses.

This rate is calculated by the ratio between costs and the fund’s total assets, and its purpose is to let you know how much will be taken out of your returns. While a reasonable fee for actively managed funds is between 0.5% and 0.75%, the typical fee for passively managed funds is 0.2%, but you may find lower rates.

Liquidity

Looking for high ETF liquidity is an important aspect to analyse, as it will influence whether the asset is traded according to its intrinsic value (or at least close to it) and whether the spread is smaller.

In this way, the investor will be able to trade at a fair price, both when buying and selling the ETF. The volume of transactions is an excellent indicator of its liquidity.

In addition, the ETF’s underlying assets also influence its liquidity. For example, even if an S&P 500 fund has a low trading volume, it will always be more liquid than a fund that focuses on investments in companies with low market capitalisation.

Another feature of these funds is their “spontaneous” liquidity. In fact, the ETF mechanism allows more units to be issued immediately, without there being a large variation in price.

Tracking error

In theory, a rise in the index that is replicated by the ETF should produce an equal rise in this fund. However, this doesn’t happen in most cases.

In fact, we will always first have to remove the associated costs (already mentioned above) and, in addition, understand whether the fund issuer is doing a good job of replicating the index (considering that some indices are easier to replicate than others).

There are other factors that influence tracking error: (1) some funds choose to acquire only a sample of the assets underlying an index and not do a full replication; (2) illiquidity generates greater spreads and, consequently, different market prices; (3) regulator rules may prohibit concentration (% of the portfolio) in a particular asset; (4) borrowing assets for short selling can also generate higher returns than the index.

Dividend distribution or accumulation

While some ETFs may periodically distribute dividends from the companies in the portfolio, others accumulate them and reinvest them automatically by buying more units. Dividend distribution is motivating, as we see our investments making a return. However, the accumulation of dividends is tax-efficient, since by reinvesting we postpone paying taxes and benefit from compound interest, which exponentiates the total return.

Risks

Each type of ETF is associated with different risks. The risk of default is not a concern in ETFs, but its importance is clear in ETNs. Funds that replicate assets from foreign countries with different currencies are subject to movements in the foreign exchange market. Market conditions are a crucial point to consider in funds with emerging market underlying assets. Bond ETFs are exposed to interest rate movements.

In this way, we see that the risks associated with each ETF are unique and varied, and therefore cannot be ruled out.

Market Position

Typically, the first ETFs to enter a certain market, sector or asset are the ones that attract the largest number of investors, which is reflected in their liquidity.

Are there better ETFs?

With a plethora of options, you should go through these 10 aspects as many times as necessary to find the right fund for your investor profile and investment strategy.

Analysis of the “Top 3 ETFs” for long-term investors

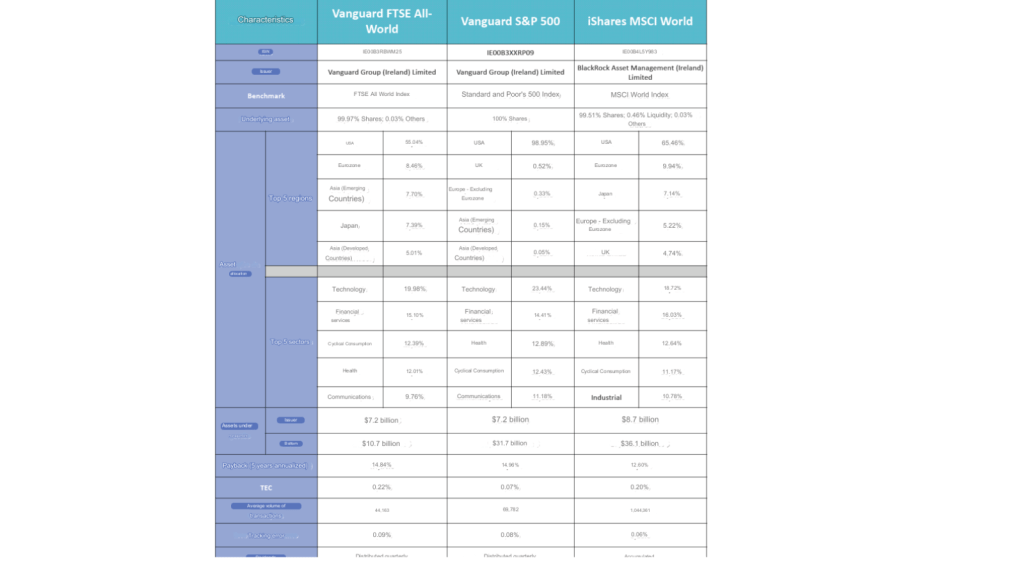

According to Degiro, these are the 3 most traded ETFs on its platform, available for purchase by European citizens: Vanguard FTSE All-World ($VWRL), Vanguard S&P 500 ($VOO), iShares MSCI World ($IWDA). In the table below, we analyse the characteristics of each of them.