What is short selling?

Short selling is an investment strategy that is not very popular with individual investors, but is widely used by financial institutions such as hedge funds and mutual funds.

Short selling is done through the following sequence: the investor borrows a share (or any other financial instrument), which is then sold on the financial market. Later, after the price falls, the investor buys it again, and finally the share is returned to the person who lent it in the first place.

This process is only carried out when the investor believes that the price of an instrument is going to fall, because only then can he buy and sell it, profiting from the price change.

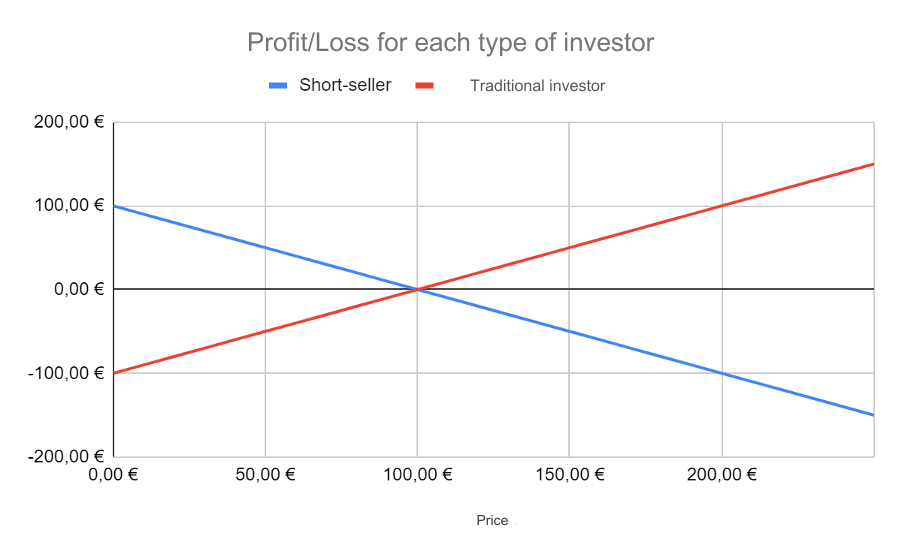

However, if expectations are not realised and the price of the instrument rises, the investor incurs losses. As you know, the price of an instrument can rise infinitely and can never be less than zero. That’s why when someone owns a financial instrument, the profit can be infinite and the loss has a limit (the cost of acquiring the asset). The opposite occurs in short selling, i.e. the gains are limited and the losses may be unlimited.

This relationship is represented in the following graph for a financial instrument purchased for €100:

Rules for Short selling

1.Never short sell S&P500 or Nasdaq!!

2.Dont short sell stocks that are going to the moon.

3. Avoid short sell when interest rates are low.

Popularity

This investment strategy is not popular with individual investors. In fact, less than 2% of transactions on the New York Stock Exchange are short sales.

This reluctance to short sell is no coincidence. As explained above, the damage of short selling has no limit and can lead to huge losses (as happened in the GameStop episode). What’s more, it’s an “unnatural” strategy, which negatively affects its popularity.

Because of these arguments, this practice is mainly carried out by institutional investors (hedge funds, mutual funds, etc.), who have expertise in the financial markets.

The impact of short selling

In part, the price of a financial instrument is determined by supply and demand. Short selling increases the number of sales, leading to an increase in supply, which translates into a decrease in the price of that instrument. However, there are those who consider this argument to be a myth.

Assuming, however, that the argument is valid, a decrease in a company’s share price has negative consequences for the company. Obtaining financing through the capital markets becomes more difficult, as the company would have to issue many new shares to obtain a satisfactory amount, greatly diluting the share of its current shareholders. In addition, companies that use capital (shares, options and so on) to remunerate employees and managers will see their salaries fall.

An undisputed impact of this strategy is on the reputation of the investors who do it. Short selling has been around for a long time, and with rather negative connotations. Even Napoleon called short sellers of government bonds “traitors”. This bad reputation stems from the belief that this strategy can turn small drops into financial market panics, leading to a vicious cycle where the price keeps falling.

What’s more, some short sellers go further and may even spread false rumours so that the price of an asset falls, in a technique known as “short and distort.”

The ethics of short selling(LOL)

Short selling is legal in most countries, only naked short selling is illegal. In essence, naked short selling involves short selling without having borrowed the instrument in the first place. However, what is legal is not always ethical.

Since the act of short selling stems from the investor’s belief that the market is overvaluing a financial instrument, by practising this strategy the investor is increasing the efficiency of the markets. This argument is consensually defended in the scientific literature.

However, as stated earlier in this article, the impact of short selling can be quite negative. Especially if it is done on instruments that are not overvalued.

Thus, the ethical question becomes dubious. Although this strategy can be done with the intention of increasing the efficiency of the markets, the impact is still negative. For this reason, the issue has been much debated without reaching any conclusion.

For now, a consensus on this topic seems unlikely.