In this article, we will explore the performance of a diversified portfolio, covering the period from January 2018 to August 2023. We chose to start in 2018 for two main reasons. Firstly, we believe that a period of approximately five years offers a suitable medium-term perspective for assessing the effectiveness of an investment strategy. Secondly, the inclusion of cryptocurrencies in our portfolio makes the choice of 2018 particularly relevant. Cryptocurrencies, although created in 2009, only gained significant traction and more recognition from 2012 onwards. If we had understood our analysis horizon to be ten years, the impact of cryptocurrencies on total return would have been disproportionately high, given their meteoric rise during that period. Therefore, our analysis aims to provide a balanced and realistic view of the portfolio’s performance.

The assets included in this portfolio were selected primarily on the basis of their popularity. The approach here does not focus on an overly technical analysis of these assets. Instead, we aim for an accessible understanding, even for those with limited knowledge, so that they can get a clear idea of where their investments are going.

This journey will lead us to build a portfolio that covers a variety of asset classes, all chosen for their outstanding presence in the market. As the focus is not to delve deeply into complex analyses, we will explore how these assets interact together. In doing so, we seek not only an overview, but also a tangible way of understanding what we are investing our capital in.

In this context, diversification is the key to what we are about to do. It’s not just about owning various assets, but understanding how these assets relate to each other, working together to reduce risk and increase returns. Choosing popular assets allows us to create a portfolio that doesn’t require in-depth technical knowledge, but still seeks the benefits of diversification. This way, even with limited resources, we can understand what we’re building and, more importantly, make informed decisions about our own investments.

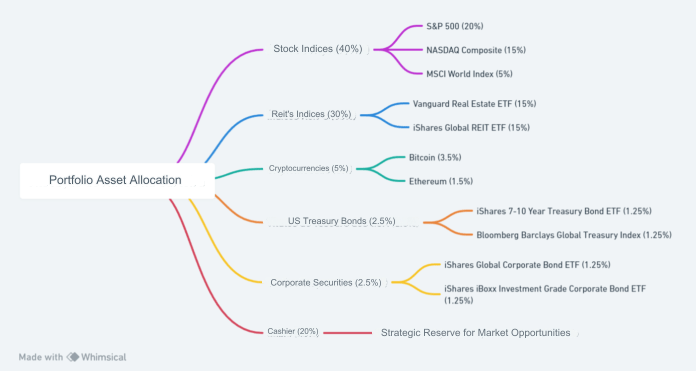

Building the Global Portfolio – Global Portfolio Constitution

Stock Indices (40 per cent)

The allocation to stock indices will be distributed between the S&P 500 (20 per cent), the NASDAQ Composite (15 per cent) and the MSCI World Index (5 per cent). This combination offers exposure to large US companies, the technology sector and stocks from around the world. The S&P 500 index is more predictable in terms of annualised return due to its track record. The Nasdaq, on the other hand, offers greater exposure to the sector that has posted the highest returns in recent years, which could be beneficial for our portfolio. MSCI World, meanwhile, provides global diversification.

REIT indices (30 per cent)

The allocation to REITs is important for us to have exposure to the property market, and will be spread across two indices. Vanguard Real Estate ETF (15%) and iShares Global REIT ETF (15%). The Vanguard Real Estate ETF invests in companies that own and operate physical real estate properties in the United States, while the iShares Global REIT ETF offers broader exposure to the global property market by investing in REITs from various countries and regions of the world. Both ETFs allow investors to access a wide variety of properties and property sectors in different international markets.

Cryptocurrencies (5%)

Cryptocurrency assets are known for their high volatility and are considered high risk. However, we have decided to allocate only 5 per cent of our portfolio to these assets in order to add a touch of innovation to our investment strategy. We will focus our investments on the two largest assets in this category, Bitcoin (BTC) and Ethereum (ETH), with an allocation of 3.5% and 1.5% respectively. We believe that this approach will allow us to capitalise on the growth potential of these digital currencies over the coming years. Instead of Ethereum i would add some shitcoins, but be aware that you need to exit at the peak of crypto cycles.

US Treasury bonds (2.5%)

Investing in US Treasury bonds provides a foundation of stability for our portfolio. The 2.5% allocation is split between the iShares 7-10 Year Treasury Bond ETF (IEF) and the Bloomberg Barclays Global Treasury Index. The IEF, with its 7-10 year maturity, seeks a balance between yield and interest rate sensitivity. Meanwhile, the Bloomberg Barclays Global Treasury Index offers exposure to a variety of government bonds around the world, adding diversification and security to our portfolio.

Corporate Bonds (2.5%)

The 2.5% allocation to corporate bonds enhances our search for yield and stability. Split equally between the iShares Global Corporate Bond ETF (CORP) and the iShares iBoxx Investment Grade Corporate Bond ETF (LQD), this allocation links us to creditworthy companies. CORP exposes us to a wide range of global corporate bonds, while LQD focuses on bonds from US companies. These securities offer predictable returns and consistently complement our portfolio.

Cash (20%)

Maintaining a robust cash allocation is a strategic and proactive approach. With a 20% cash reserve, we guarantee the flexibility needed to capitalise on emerging investment opportunities and to adapt to market fluctuations and variations in the portfolio itself. While other assets in the portfolio are subject to volatility, the cash allocation acts as a pillar of stability and security. It’s important to note that although we have established a 20 per cent allocation to liquidity, this figure can actually be higher. This is due to the inclusion of 5 per cent in treasury and corporate bonds, which, due to their low-risk nature and greater liquidity, can be considered an extension of our cash reserve. This combination brings our “safety cushion” to around 25% of the portfolio, reinforcing our ability to manoeuvre in variable market scenarios.

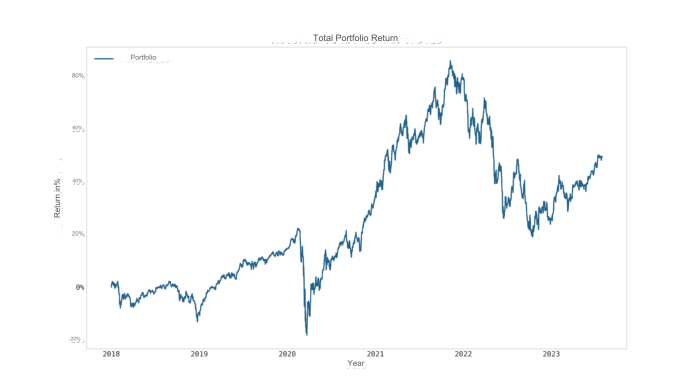

Detailed Analysis of the Performance of Our Diversified Portfolio (2018-2023)

The performance of our diversified portfolio from the start of 2018 to August 2023 has been remarkable, with a total return of approximately 50 per cent. This translates into an impressive annual average of almost 10%. Let’s break down these figures to better understand how each asset class contributed to this success.

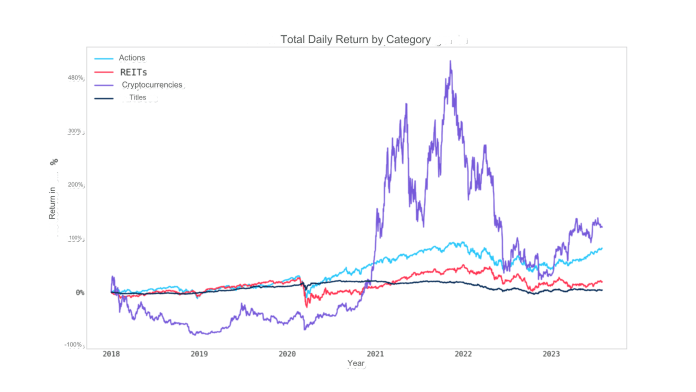

Equities: The Pillar of Growth

Equities, represented by the S&P 500, NASDAQ and MSCI World indices, were the backbone of our investment strategy. With returns of 70.22 per cent, 104.74 per cent and 64.87 per cent respectively, these indices not only added stability to the portfolio with all their diversification, but also contributed significantly to capital growth. The allocation of these assets was based on their relatively low volatility and long-term return potential.

Real Estate: Stability with Moderate Returns

REITs, specifically Vanguard Real Estate and Global REIT, performed more modestly than expected, with returns of 26.93 per cent and 12.43 per cent respectively. Their inclusion in the portfolio was intended to add a layer of stability and diversification, despite more restrained returns.

Cryptocurrencies: The Bold Touch

Cryptocurrencies, namely Bitcoin and Ethereum, were the unexpected stars of the portfolio. Despite their high volatility, they generated exceptional returns of 114.02 per cent and 140.23 per cent. Their allocation was made cautiously, to balance risk and return.

Bonds: The Solid Base

Bonds, often seen as the safe harbour of investments, had returns ranging from 0.04% to 7.3%. Their presence in the portfolio was strategic, aimed at mitigating the risks associated with other more volatile assets.

Portfolio volatility

The volatility of our diversified portfolio was approximately 0.83 per cent per day, a figure that reflects careful asset allocation management. To better understand this figure, it is useful to explain the risk components associated with our portfolio: diversifiable risk and non-diversifiable risk.

Diversifiable Risk: The risk related to individual factors of each asset in the portfolio is known as diversifiable risk. To reduce this risk, you can choose to diversify your portfolio by including a variety of assets. In our case, the diversifiable risk was around 0.00518%.

Non-Diversifiable Risk: This is the risk associated with market factors that affect all assets and therefore cannot be eliminated through diversification. Our non-diversifiable risk was around 0.00175%.

The low level of these risks demonstrates the power of diversification. By allocating more volatile assets, such as cryptocurrencies, with lower weights and less volatile assets with higher weights, we were able to keep the portfolio’s volatility at manageable levels. This is a positive indicator, as it suggests that the portfolio is well balanced and less susceptible to extreme market fluctuations. To summarise, the asset allocation strategy has resulted in a portfolio with well-controlled risk, which is excellent news for any investor, whether novice or experienced.

Conclusion: The Art of Diversification Within Everyone’s Reach

The idea of investing in the financial market can often seem intimidating, especially for those who don’t have a background in finance or economics. The good news is that you don’t need to be a world-class investment expert to build a diversified and profitable portfolio.

Our experience shows that, with a careful and strategic approach, it is possible to achieve a total return of around 50 per cent and an average annual return of around 10 per cent. And this has been achieved through intelligent diversification, taking into account the volatility and return potential of each asset.

You don’t have to be a financial expert to understand that different assets have different levels of risk and return. What really matters is how these assets are combined to create a balanced portfolio. This portfolio is living proof that effective diversification can mitigate risks and maximise returns, making the world of investments accessible to everyone, regardless of their level of expertise.

It is important to note that the portfolio presented and analysed here does not constitute an investment recommendation. Each investor has unique objectives, risk tolerance and financial situation, which must be taken into account when choosing an investment strategy. This analysis serves only as an illustrative example of the impact of diversification and asset allocation on a portfolio’s performance.