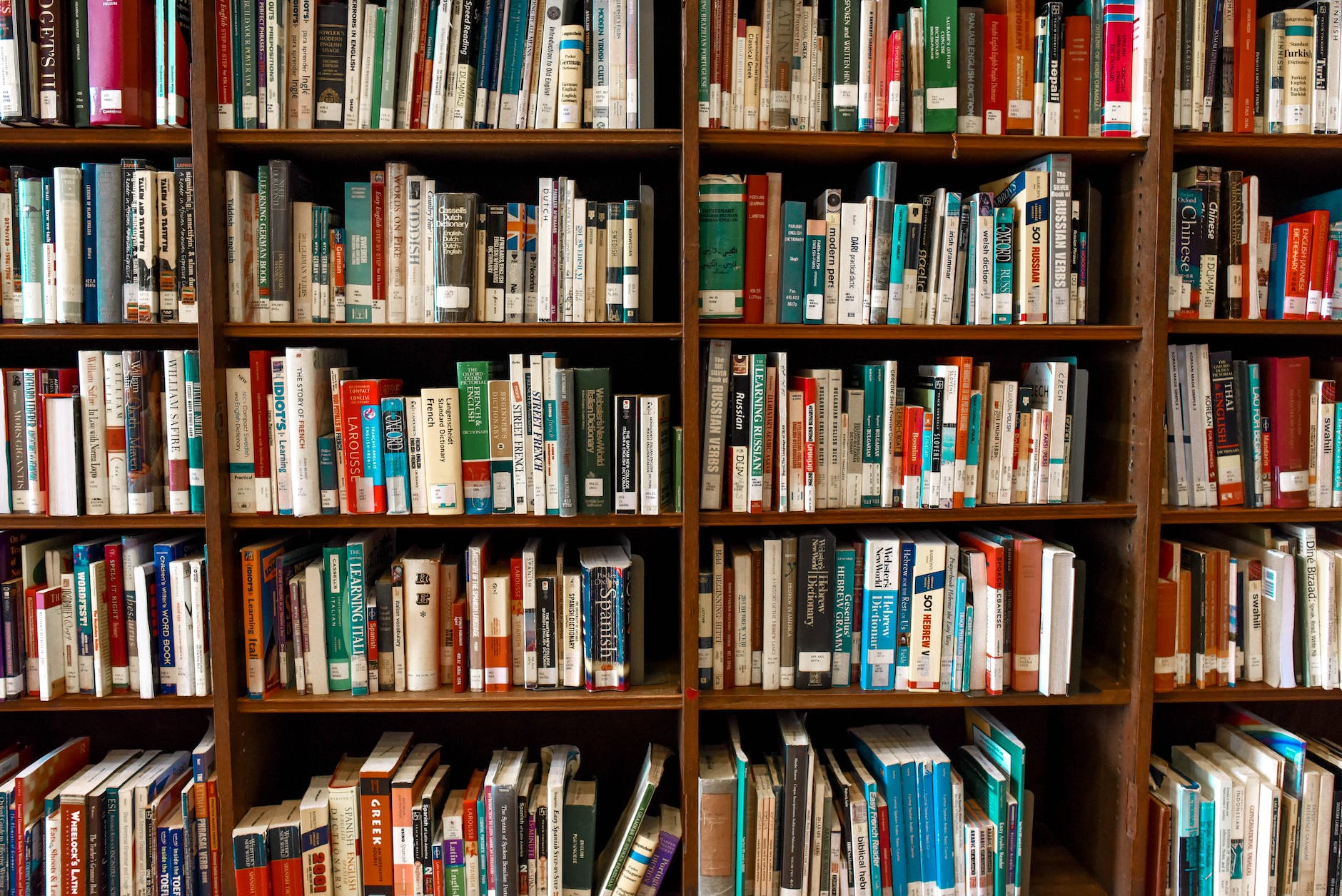

This my top selection (2023)for reading if you are starting in the stock market, Crypto, ETFS or even if you are already Investing for some years bu looking to have a different perspective on how to approach your Investments. If you are in this page you are already winning because reading and learn from more experienced investors is the right path to a successful life of investments.

- “Trade Like a Stock Market Wizard” by Mark Minervini – My top book! This book offers actionable advice for achieving shot to mid-term investment success and provides a practical framework for stock market investing. Minervini’s techniques are based on years of experience ( and contest winning) and a deep understanding of market dynamics. Buy on Amazon

- “The Intelligent Investor” by Benjamin Graham – A classic investment guide, “The Intelligent Investor” teaches readers the principles of value investing and how to approach the stock market with a long-term perspective. Graham’s insights and practical advice have stood the test of time and continue to be relevant today. You Buy it on Amazon.

- “The Little Book of Common Sense Investing” by John C. Bogle – Bogle, the founder of Vanguard, offers a simple and straightforward approach to investing that emphasizes low-cost index funds and a focus on long-term returns. Buy it here.

- “The Lean Startup” by Eric Ries – This book provides a step-by-step guide for entrepreneurs looking to build successful companies from the ground up. Ries emphasizes the importance of innovation and adaptability in the face of rapid change and uncertainty.

- “The Psychology of Money” by Morgan Housel – This book explores the psychological and emotional factors that influence our financial decisions and how they can impact our long-term success as investors.

- “The Essays of Warren Buffett” by Warren Buffett – This collection of Buffett’s letters to shareholders provides insight into the investment philosophy of one of the world’s most successful investors. A Must buy!

- “The Black Swan” by Nassim Nicholas Taleb – Taleb’s book explores the concept of black swan events, or rare and unpredictable occurrences that have a major impact on the world, and how to protect against them in investing.This book will help you with rational thinking. Buy on Amazon

- “More Than You Know” by Michael J. Mauboussin – This book provides a comprehensive overview of the various factors that influence investment decisions and offers practical advice for improving your investment outcomes.

- “Value Investing: From Graham to Buffett and Beyond” by Bruce Greenwald, Judd Kahn, Paul Sonkin, and Michael van Biema – This book provides a comprehensive overview of the principles and practices of value investing, drawing on the insights of some of the field’s most prominent thinkers.

- “The Warren Buffett Way” by Robert G. Hagstrom – This book provides a detailed analysis of Buffett’s investment philosophy and techniques, and shows how ordinary investors can apply them to their own portfolios.

Investing is a critical aspect of financial planning that can help secure a person’s financial future. With the right investment strategy, one can grow their wealth, achieve financial stability and independence, and plan for retirement. Learning about investing and developing the skills to invest effectively is essential to achieving these financial goals.

Investing in the stock market, real estate, or other assets can help build wealth over time. Unlike savings accounts, which only offer a low interest rate, investments offer the potential for higher returns and can help beat inflation. This means that an investment portfolio can grow faster than the cost of living, allowing an individual to maintain their purchasing power and improve their standard of living.

One of the key benefits of investing is that it allows individuals to take control of their financial future. By investing in the stock market, real estate, or other assets, people can ensure that their money is working for them, rather than just sitting idly in a savings account. This not only helps build wealth but also provides peace of mind, knowing that one is proactively working towards their financial goals.

Investing also offers a means of diversification, which is critical in managing risk. Diversification means spreading investments across different asset classes, such as stocks, bonds, and real estate. This helps to reduce the impact of any single investment’s performance and minimizes the risk of significant losses. This is especially important for those who are new to investing and may not have a lot of experience in choosing the right investments.

Learning about investing and developing the skills to invest effectively requires effort and dedication. However, the rewards are well worth it. With the right knowledge, one can make informed decisions about where to invest their money and how to manage their investment portfolio. This can result in higher returns, lower risk, and a greater level of financial stability.

There are many resources available for those who want to learn about investing, including books, online courses, and investment professionals. Some of the best investment books for beginners include “The Little Book of Common Sense Investing” by John C. Bogle, “The Intelligent Investor” by Benjamin Graham, and “The Simple Path to Wealth” by JL Collins. These books provide a solid foundation in investment principles and strategies, and offer practical advice for building a successful investment portfolio.

In conclusion, investing is a critical aspect of financial planning that can help secure a person’s financial future. It offers the potential for higher returns, allows individuals to take control of their financial future, and provides a means of diversifying risk. Learning about investing and developing the skills to invest effectively is essential to achieving these financial goals. There are many resources available, including books, online courses, and investment professionals, to help individuals gain the knowledge and skills they need to succeed in investing.